Banks have to operate as per the guidelines of the Reserve Bank of India. However, if the customers are not satisfied with the banking services, or they do not find them up to the mark they can close their bank account in their respective Bank.

Quite a several times, banks offer lucrative schemes for opening an account in a particular bank branch, which may also prove to be a possible reason for shifting a bank account into another branch. A few banks charge their customers for the closure of accounts while some are sad to let them go and do not charge anything.

Just like a few other banks, the bank of banks State Bank of India has waived off the closing charges for an account in recent times. However, there is a drawback for the customers of State Bank of India because they cannot close their account online which may be a possible facility provided by other banks in the country.

This is why it becomes essential for the customer to visit the home branch where their account was opened and have to get it closed by visiting the branch personally. SBI savings account or SBI salary account, the procedure for closing is the same for both accounts.

In case a customer is having a savings or current salary account with the State Bank of India and wishes to close it forever there is a detailed procedure for professionally closing the SBI account. There are a few things that customers need to remember before closing their SBI account. These are as follows:

- In case due to an emergency, or any other possible reason if the customer wishes to close their SBI account, they are not eligible for reopening it again. This drawback can create a hassle in the future for the users.

- The user needs to leave zero balance in their account before proceeding with the account closing procedure. This is why, if the customer is having a good bank balance they need to shift it to another account or withdraw it immediately, for carrying out the closing procedure in the State Bank of India.

- In case there are a few pending dues on account of the customer’s account, and then they must be cleared before proceeding with the closure of the account. In case the dues remain pending the customer is not allowed to apply for the closing procedure of the account in the State Bank of India.

- In case the customer wishes to make some future use of the account, then they need to have a complete bank statement of their SBI account.

Steps that are needed to be carried for closing the bank account in the SBI branch

Step 1: Step into the SBI branch in which the account is located

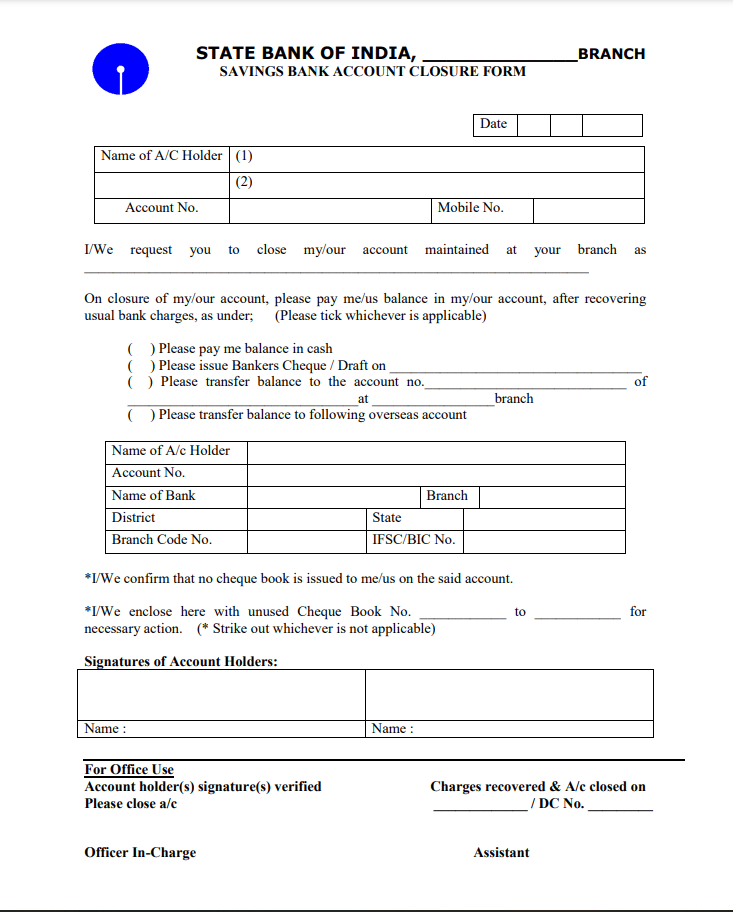

- An account closure request form will be provided by the bank executive to the customer. The form is also known as CDSL. if the user wishes to save a few minutes then they can also download the SBI account closure form from the official SBI website under the heading SBI account closure form. After receiving the form the user needs to fill it up for carrying with the proceedings.

- The user needs to complete the form by mentioning the name of the account holder as per the bank account, account number of the user, signature, and contact number of the account holder.

- The user also needs to state a few reasons for closing the account in the respective branch.

- The user also has the option of transferring the amount off the bank balance by cheque, DD, cash or they may also transfer it to two other accounts. This option needs to be filled in the form.

Step 2: After the above procedure is complete it the user needs to return the Chequebook along with the debit card and passbook.

- Cheque book: The SBI bank account holders must return their checkbook along with the unused or remaining check leaves to the respective Bank branch of State Bank of India at the time of closing their account. The same checkbook is used for withdrawing any kind of money from the bank account as well.

- Debit card: In case the account holder has a debit card they must return it to the State Bank of India branch. This debit card is used for withdrawing any kind of amount of money from POS or ATM branches.

- Passbook: The user must return their passbook at the time of closure of the SBI bank account.

Step 3: Submit ID proof and address proof documents

There are a few SBI branches that ask their valuable customers for ID proof and address proof for closing their SBI account. The account holder must provide them with the same. After the procedure of account, closure is completed the account holder will receive an SMS and email notification on their registered mobile number and email ID. In case the customer is having any kind of issues with the State Bank of India account closing procedure then they can freely call the toll-free number 1800112211 of the bank.

| Services | Contact |

|---|---|

| Toll-free Number | 1800 1234 1800 11 2211 1800 425 3800 |

| [email protected] [email protected] |

Charges

There are a few banks that levy a feast for the closure of the account in their branch. they do so for recovering the cost of a variety of services provided to the customers during the opening of the account, which may include the cost of a chequebook, debit cards, and other things. However, the State Bank of India has waived off the charges for account closure in recent times for the account holders of more than one-year-old accounts.

In case the user feels the need to close the account within 14 days of opening it due to any particular reason SBI does not charge them anything. However, in case the account is being closed between any times from 15 days to one year then a sum of INR 500 and GST as applicable in earlier times. With effect from 1st October 2017, the new policy of the bank is applicable stating nil charge GST for the closure services.

Be the first to comment