In this generation, taxation is a subject that works like a mandatory process for every citizen in a country. Basically, tax is the necessary payment that every individual is bound to pay to the government entity for the endowment for government activity. It is the fixed amount that every citizen has to pay to the government for the provision they get from the government in a varied percentage.

There are various modes of taxes like Income Taxes, Payroll Taxes, Sales Taxes, Consumption Taxes, House Taxes, etc. Generally, we imagine income tax when hearing the word Tax, even if it’s Personal Income Tax or Corporate Income Tax. However, taxes are more than just income tax that uses as a minimum payment for some services in other areas of the economy.

How The Government Benefited from Income Tax?

People usually don’t take the tax as the service fee they get from the government, rather take it as a burden. Income tax is the one that the government imposes on the citizens for their earnings that can be from any resource. It is the only one that people give directly to the government, and the tax percentage depends on the income level of individuals.

The percentage counts on an average income over a financial year. This income tax helps the government to accomplish different schemes for taxpayers and advanced employment programs. The action of this processing made revenue for the government to finance public services by constructing new roads, schools, and hospitals.

Income Tax Intimation Order

The tax department sends the intimation notice to the taxpayers with appropriate detailed information after processing the ITRs. People file their income tax returns when they give in tax fees required with their income value, and there it shoots over the pay rate. After filing and verifying the income tax return form, the department will notify the payers with an intimation letter. This intimation notice is sent to the registered Email Id of the tax filer by the tax department under section 143(1).

The tax department notifies them with an SMS alert to the tax filer. The time limit to issue the income tax intimation order has been amended to three months. The intimation order is the one that confirms the action of tax payment is pending or not to the particulars. It is a mandatory function in the tax pay role in order to clear the taxation upon every individual’s income.

Reasons for receiving an Intimation

A person can receive the income tax intimation notice at any time from the tax department. According to the Indian Tax rules, the department can send an intimation notice within 9 months from the end of the financial year.

People get the intimation as a notification without any positive or negative impact of taxation under section 143(1). But, this intimation got to send for some reason to the taxpayers. It’s a system-generated message that has no human intervention stating the fact of errors of pending payables or refundable.

We are here to mention the focus reasons for getting an intimation. It can be the primary reason for this, and those individuals who will get the intimation might have to work on this.

TDS Amount Delusion: It’s a most common error in the department with income tax returns. Usually, the employees at the tax department deduct the specific amount that has been shown in one’s record. But sometimes, they mistakenly deduct more from the payer’s salary account. Thus, the department sends the intimation of a refund of the extra amount.

Casual investigation: The Income Tax Department sends an intimation to the taxpayers for random verification of the records and data used while filing Income Tax Returns. The taxpayers must cooperate with the employees there in such circumstances with their valid data. It will help the department quickly match the information with the original data.

Review Documentation: In this case, the tax department sends an intimation to the taxpayer, as it’s a formality to check the ITR V acknowledgment. Consequently, the taxpayer should be available with the necessary documents to verify the income tax return filing. This verification occurs to clarify the tax return form filing is correct in the form of originality.

Dissimilarity in Tax Return Filed: In this scenario, if the tax department finds out the amount the taxpayer declared and the amount of tax shown in the Income Tax Department are different, the department may send an intimation to the taxpayer. Sometimes people forget to provide correct information regarding the source of income to the tax department.

Income Tax Intimation Order Password

The Income Tax Intimation sends under section 143(1) to let the taxpayers know whether they owe some extra amount of tax or are just due for a refund. However, the intimation sent under section 143(1) is difficult to understand. Though, a person shouldn’t ignore any notice sent from the income tax department and prior read that earnestly. The tax department examines for any inaccuracy or instability, and tax calculation then confirms tax payment mode while processing the ITRs.

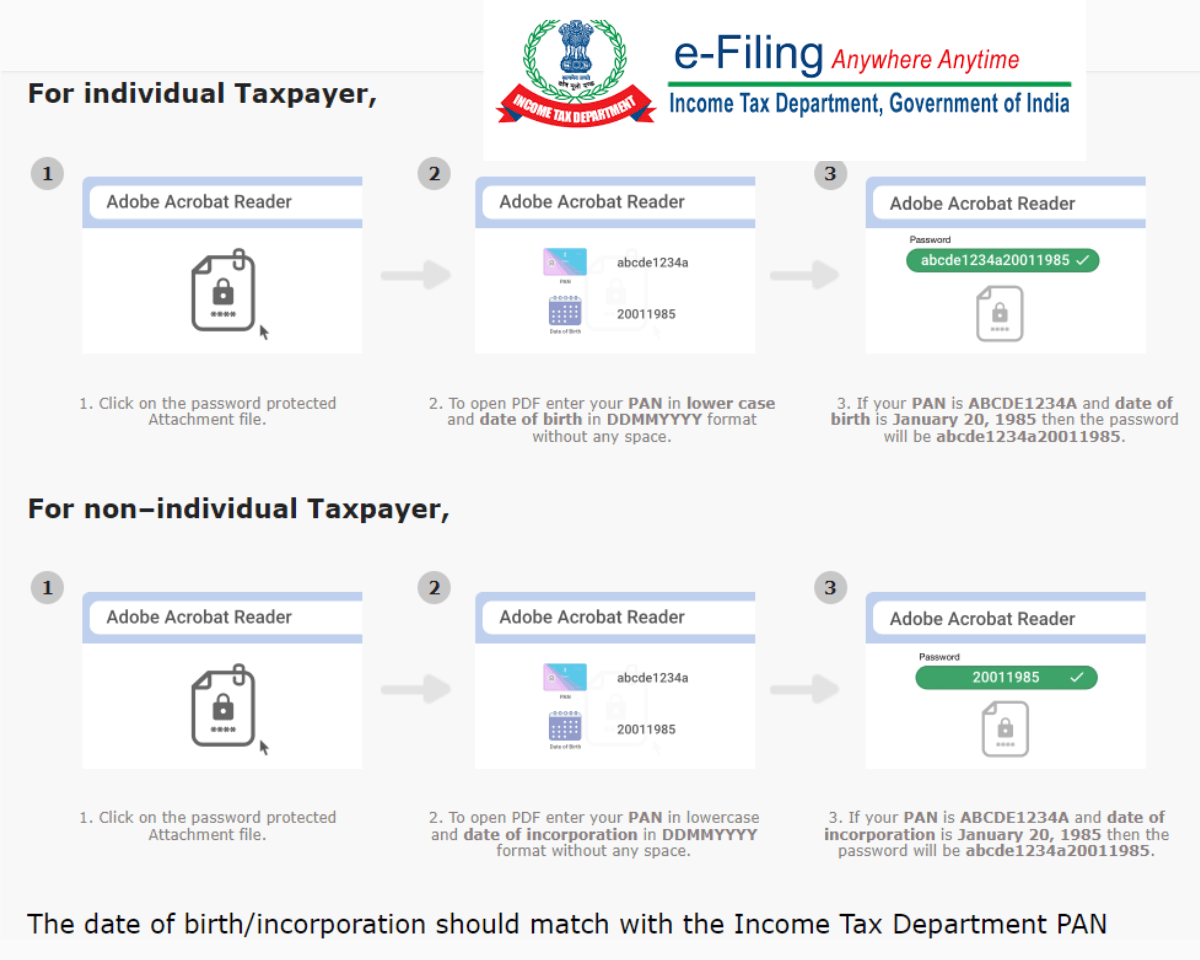

Here, important information is the income tax intimation notice needs a password to open it. The income tax intimation order is password-protected under section 143(1). It’s a Pan-generated password, and to open the intimation order, one has to have the Pan number remembered.

To open the income tax intimation order on the taxpayer’s device, enter the PAN number along with the individual’s date of birth. For example, if the PAN number is MATPSH567L and the birth date is 04.06.1996, then the format would be matpsh04061996.

Intimation Order Password Example:

| PAN NUMBER | DATE OF BIRTH OR INCORPORATION OF COMPANY | INTIMATION ORDER PASSWORD FORMAT |

|---|---|---|

| DEFCF7354F | 20 January 1986 | defcf7354f20011986 |

| HEFTE3245G | 11 November 1995 | hefte3245g11111995 |

| BKTHT4563H | 2 March 2002 | bktht4563h02032002 |

| UFKEG7832D | 25 July 1999 | ufkeg7832d25071999 |

Conclusion

According to Income Tax Department, tax intimation sends to the taxpayers under section 143(1) of the Income Tax Act, 1961. Whenever the intimation arrives, a taxpayer shouldn’t fret and should check to confirm on their own about the Name, PAN number, assessment year, etc. Generally, the Income Tax Department doesn’t ask for any additional details in order to tax refund to the taxpayer that will be paid out eventually.

Taxpayers can get other 7 different types of intimation under separate sections as per the Income Tax act. An Income Tax Intimation is nothing but some simple inquiry about the taxpayer’s ITR documentation. We anticipate this article will be beneficial to you. This article will help with every similar aspect of Income Tax Intimation.

Be the first to comment