Banking plays a vital role in our lives, and we all know that. A bank is an organization, which helps us to manage our financial developments. Banks usually borrow and lend us money, and for that bank conducts interests. You need to open an account in your desired bank only, and then the work will begin.

Once the account is created they will give you a passbook to update monthly for your financial track details. Banking has its various terms that should be under some restriction and procedures. CLG is one of them, and its use for attaining financial transactions means clearinghouse transactions in banking terms. The clearinghouse is a voluntary association under bank management.

The CLG is a banking term with a department of settlement accounts management. The Reserve Bank of India office with a banking department manages the clearinghouse. However, the State Bank of India manages the clearinghouse associated with the Reserve Bank of India due to the absence of its office in some areas.

Even in few cases, the clearinghouse is maintained by some private banks as well by the Reserve Bank team itself. There are 1150 cheque clearinghouses all over India clear and settle transactions related to various type of paperwork like cheques, interests, payments, drafts, etc. The Reserve Bank of India has offices at 31 locations. Sometimes you can notice while updating your passbook there are some CLG printed beside your transaction statement.

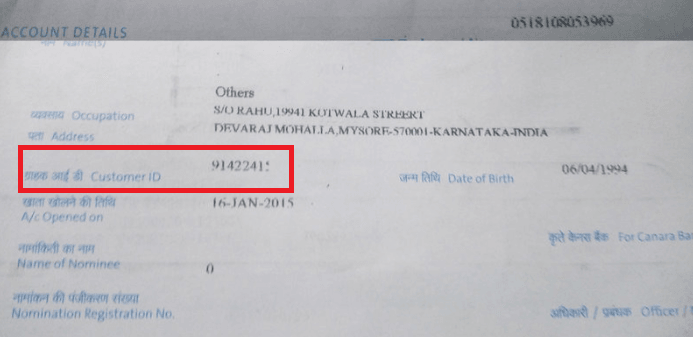

It means a person gave you a cheque as a payment for something, and you deposit the cheque to the same bank or another to transfer the money to your account accordingly. Your bank asks for the amount of money that the cheque holds from the particular bank of your cheque giver. When the bank credits the amount to your account, complete the settlement, called clearing.

Here some commitment works like the person who gave you the cheque consists of a promise for fund transfer to your account. The banking staff who has maintained the records of money owed to their bank and the other banks handle the cheques after office hours every day.

The cheque transaction system is continuing for decades. Now, the system moves towards electronic methods it improves the time duration for fund credits. The Cheque Truncation System(CTS) is now introduced by the Reserve Bank of India to faster and easier money transfer services providence to the customers.

Conclusion

Hence, CLG occurred a milestone in banking by giving services to bank customers. As mentioned earlier that banks are now converting their CLG system to electronic mode to provide more security. People are getting their money credited to their accounts much faster and without any issues. We hope you will find this information helpful. If you want more information relating to banking please visit our website xxx.

Be the first to comment