Infrastructure Development Finance Company is also known as IDFC bank. Hence, it is an infrastructure finance company. IDFC First Bank is a part of IDFC bank. It is an Indian private sector bank.

It had started its operations in October 2015 and is headquartered in Mumbai. It has over six-hundred branches spread all over India. This bank is also listed on National Stock Exchange and Bombay Stock Exchange.

Reasons For Closing an Account in IDFC First Bank

There can be many reasons for an account holder to shut down their current account or savings account or fixed deposits account in the IDFC First Bank. A few reasons that can be listed are:

- High transaction charges.

- High account maintenance charges.

- Issues regarding customer service.

- If the bank requires a minimum account balance.

- The account holder has multiple accounts in the same bank.

- Lower rate of interest, etc.

All or some of the reasons listed above can result in the shutting down of an account by the account holders in their IDFC First Bank account.

Steps To Be Followed To Close An Account In IDFC First Bank

With the help of the following steps, an account holder can easily close its account permanently in the IDFC First Bank. But before closing the bank account, the account holder is required to maintain a minimum balance with the bank.

The minimum balance required to be maintained every month ranges between ten thousand INR to twenty-five thousand INR, depending upon the nature of the account.

The steps to be followed to close the IDFC First Bank account are:

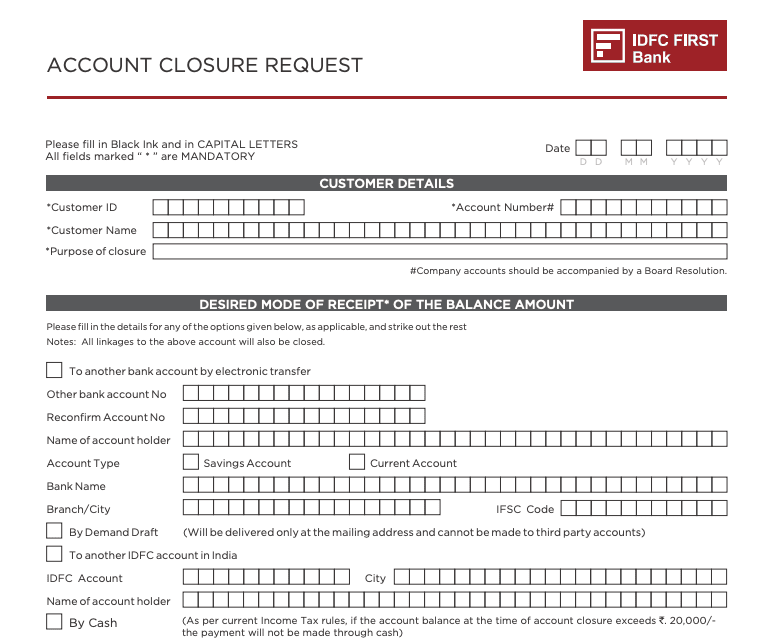

Step 1: Firstly, the account holder may download the account closure form online. Then, he must get the printout of the form. If he has not downloaded the form online, then he can visit the IDFC First Bank branch and get the physical copy of the form from the bank itself.

Step 2: After generating the form, the account holder must duly fill in his details as well. The personal details required to be filled up in the form include the account number of the bank to be closed, the name of the account holder, etc.

Step 3: After entering all the details, the account holder must sign in the space provided in the form. He must make sure that his sign matches the one which is already available in the bank records. In the case of joint account holders, all the holders need to sign the bank account closure form.

Step 4: After filling out the form completely and wisely, the account holder must check it thoroughly. Once assured, he must hand over the filled form to the branch manager.

Step 5: Apart from the IDFC First bank account closure form, the account holder must also submit his self-attested KYC documents such as PAN and proof of address. PAN serves as the proof of identification of the account holder.

Step 6: Alongside KYC documents, the account holder must hand over his debit card, his passbook, and the balance cheque left to the branch manager.

Step 7: After all the necessary documents are produced and submitted with the account closure form, then the IDFC First Bank account closure application gets final approval and is forwarded for further processes.

Now, the bank verifies all the documents of the account holder and if it passes the verification test then it allows the account holder to withdraw his available funds from the bank account.

Once the IDFC First bank account is successfully closed, the bank sends a confirmation message to the account holder either through an SMS on their registered mobile number with the bank, or through an email on the registered email ID of the customer, with the bank.

By following the process discussed above, the IDFC First bank account holder can easily close his IDFC First bank account.

IDFC Bank Account Closure Charges

| Services | Charges |

|---|---|

| Account Closure | Free |

Conclusion

Any person can easily open their account in the IDFC First Bank online, but the bank does not allow the facility of closing an active account through the online procedure. Hence, to shut down their bank accounts an account holder needs to visit his branch compulsorily.

Though, the only ease that the bank provides to its customers is that they can download the IDFC First Bank account closure form from the bank’s official website online as per their convenience. But for the verification and the confirmation of their decision, the account holders need to visit the physical branch mandatorily.

Though the bank account gets shut down easily, the account holder should take his decision wisely. He must ensure that all the necessary formalities are done effectively and through legal channels only.

Please sir close account number