Being the third-largest private bank in India, Axis Bank holds an important position in the Indian economy. A majority of companies operating in India prefer their employees’ salary accounts to be opened in Axis Bank. It is all because of the benefits Axis Bank is providing to its uses.

For example, no minimum balance, exciting rewards on each shopping trip, great customer service, and a personalized manager are some of them. In addition to the safety of their money, Axis Bank is also providing a personal touch of services to its customers. However, under some intolerable circumstances, there may occur times where customers may feel the need to close their Axis bank account.

Procedure For Closing Axis Bank Account

If a user is having a normal kind of Axis Bank savings account they need to maintain at least INR 5000 in their account. For some, it may be crucial to maintain this amount depending upon their financial conditions. In case the user is not able to maintain this minimum balance Axis Bank charges them with some amount, which may be difficult for poor people to pay. Therefore to avoid any further charges they may opt for the closing of their Axis bank account.

Before applying for closure of the Axis bank account, the user many to transfer or withdrawal all their funds either in the form of UPI, NEFT, RTGS, IMPS they can also use their debit card and at their money in their Paytm wallet. In addition to this, the user is also allowed to withdraw the remaining balance in their Axis bank account and get it deposited in any other bank of their choice.

Following are the steps that can be followed for closing an Axis bank account:

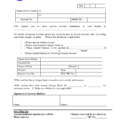

- After withdrawing all the leftover balance from the account the user needs to download the Axis bank account closure form from the official website of the Axis Bank. The user can also visit the bank branch and obtain this form.

- As soon as the user receives the form they need to fill it with the necessary details.

- After filling in the details the user needs to visit the home branch. They must carry their debit card, original bank passbook, ID proof, and Chequebook along with them.

- The user needs to submit the duly filled form to the bank executive along with their Chequebook, debit card, and passbook issued at the time of opening the Axis bank account. In most cases, the passbook is returned to the user. In case the user is skeptical about it they can also save a photocopy of the mentioned documents for their future reference.

- After this procedure is complete it the bank executive will provide a reference slip which is necessary for the closure of the bank account.

- As soon as the slip is provided to the user it takes about 10 working days for the Axis bank account to get closed.

- After the closing procedure is completed the user will receive a message on their registered mobile number and an email on their registered email ID.

- In case it takes more than 10 days for this message to be received by the user they can contact the branch manager directly or they can reach out to customer care at 1860 419 5555 in case of any further assistance.

| Services | Contact |

|---|---|

| Toll-free Number | 18604195555 18605005555 |

| [email protected] |

Conclusion:

This was all about the procedure for closing the Axis bank account offline. Unfortunately, at present, there is no such procedure that is available for closing the Axis bank account online. This makes it necessary for the user to visit the bank branch and get their account closed by following the above-mentioned easy steps. In case any assistance is required by the user Bank officials are always present there to help them out.

Be the first to comment